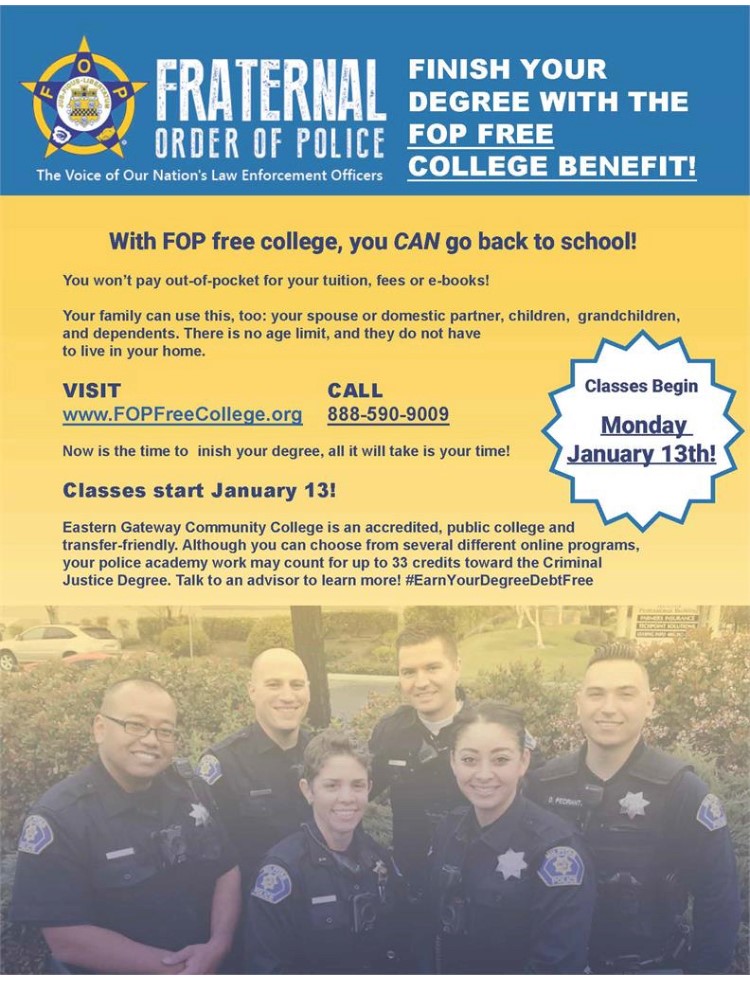

The Fraternal Order of Police (FOP) is offering a free Associate of Arts degree in Criminal Justice and other areas for current members of FOP. See attached flier with the information. There is a number to call and or instructions to apply on the attached document. All courses are on line and best yet, FREE. However, you must be a member of FOP. Email John Tuchek (jtuchek@fop.net) or any SEIU 721, BU 702 Board member if your not a member and want to become one.